WHY IT MATTERS: The south Wood County area has financial capital, expertise, physical space, and a strong entrepreneurial spirit needed to generate growth from within. Our regional economy has begun producing “green shoots” of economic growth. Our decisions and actions – as consumers, business owners and community leaders – can nourish this growth to yield a locally-driven economy, providing economic opportunity for all.

Growing SWCA’s economy allows us to think about how best to leverage our local resources – human, physical, financial, and natural. We must focus on both our traditional drivers of economic growth, and new opportunities coming to our region.

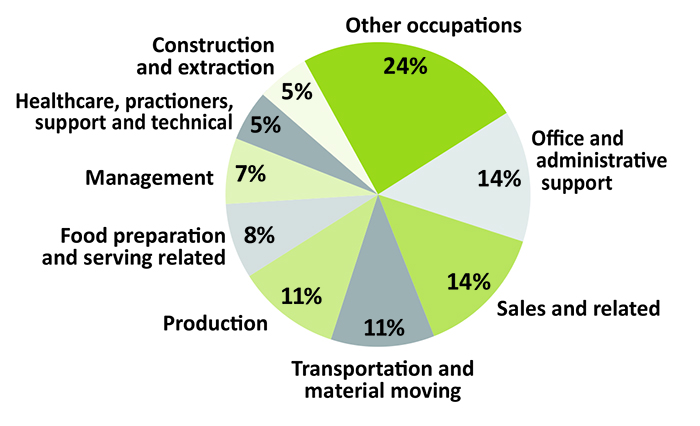

The aging of SWCA’s workforce and the age profile of some local businesses has led the state to project that most jobs (67%) created over the next decade will come from businesses replacing workers, not industry growth. Production, transportation, sales, and office and administrative support alone are projected to have over 2,400 combined replacement jobs.

Although national research suggests that small businesses – and certainly young businesses – are not a consistent source of new or particularly high-wage jobs, entrepreneurship remains a key asset for communities. Entrepreneurship can help keep talent, financial resources and innovation within a community. The data on SWCA business starts demonstrates impressive entrepreneurial energy. 306 businesses were started in the region during the last year and 800 over the last three years.

Two community resources for economic growth are financial and physical capital. SWCA benefits from both. In terms of financial capital, SWCA is helped by a banking industry with 18 financial institutions, operating a total of 30 branches locally. Seven of these branches are community banks – institutions that typically have local ownership, lend within the region, and consider factors such as personal character and integrity when making lending decisions. Another seven are credit unions, which have a similar community focus.

SWCA also has good availability of commercial space (at least 570,000 square feet) and potential industrial sites (over 100 acres).

Many of our dominant industries operate within international markets impacting local job opportunities, quality, and security. This can make it feel as though forces far outside our community control our access to a “good job.” But our local economy is also built from locally-owned businesses of all sizes and geographic reach, and from the residents who supply and consume products within the region. The stronger we build this local economic infrastructure, the more we sell products and services throughout it. A stronger local economic infrastructure, attention to and support of local purchasing, and greater flow of goods and services inside our region can build a stronger and more resilient economy for us all.

This is important not only to help further our economic growth, but to extend and sustain opportunity. Communities across the country have begun to take back control over their local economies. One approach taps local agricultural and natural resources to create a local value chain – embedding value in locally sourced raw materials, employing residents to add that value, and returning the financial gains back to those workers.

What informed choices can you make to help strengthen the local economy?

Vital Signs covers the south Wood County area of Wisconsin, including the municipalities of: Biron; Cranmoor; Grand Rapids; Nekoosa; Pittsville; Town of Port Edwards; Village of Port Edwards; Town of Rudolph; Village of Rudolph; Saratoga; Seneca; Sigel; Vesper; Wisconsin Rapids; and Rome in Adams County.

For additional information, contact:

Incourage | [email protected] | 715.423.3863

We’d love to

hear from you.